As the Ethereum blockchain kept gaining traction, the throughput and other properties began to shrink. To solve this, the core developers have to move from Ethereum POW to POS. POW allows miners to spend enormous energy to validate transactions and create new blocks on the blockchain. On the other hand, POS enables the community to stake Ether, Ethereum native token to improve security, decentralization, and scalability. While the exodus to Ethereum 2.0 opens an intuitive way of solving inherent problems of the Ethereum network, it paves ways for cryptocurrency traders to make money staking ETH.

Ethereum 2.0 staking and Beacon Chain

The journey to Ethereum 2.0 is evolving from 0 to 3+. Beacon chain, the forerunner of Ethereum 2.0, is phase 0 of attaining serenity. It is a transition or a coordination layer for the ETH 2.0 architecture. To move to proof of stake, the Beacon Chain, launched on December 1st, 2020, enabled Ethereum staking in the deposit contract.

Similar to traditional staking, Ethereum 2.0 staking means locking up an ETH deposit for a certain period. It requires stakers to act as a network validator by depositing a minimum of 32 ETH provided they have access to the internet and a standard computer. Unlike the POW, the Ethereum 2.0 network users stake their ETH to secure and validate transactions in exchange for ETH staking rewards. The Ethereum 2.0 staking also allows the staker to share in the Ethereum 2.0 network transaction fees.

To start making money staking ETH, crypto traders need to run a validator node and lock up a minimum of 32 ETH tokens in a deposit contract. Staking ETH allows users to participate in block creation where validator nodes will be selected to vote on new blocks semi-randomly and reach a consensus with other validators.

Method of staking ETH for ETH

There are two ways to make money staking Eth on Ethereum 2.0. Participants can choose between the two depending on the availability of resources and stable internet. They include making money as a full node or through staking pools.

How to Make Money Staking ETH As A Full Validator/Node

The basic requirements of becoming a full validator are simply staking 32ETH and running the Eth 2.0 client. It allows users to deposit 32ETH on the Eth 2.0 software to run a node and take full profit. Below are steps to running a full node;

- Downloading a local copy of the blockchain- the Eth1 client and the Eth2 launchpad.

- Setting up and running the Eth2 terminal.

- Install the validator software.

- Learn how to manage keys and protect a mnemonic.

- Buy ETH after comparing exchanges.

- Deposit a minimum of 32ETH to the official ETH staking address after verifying it at ethereum.org.

However, stakers can choose to stake solo by running it through the wallets but must deposit 32ETH on the deposit contract. Users can do this by depositing 32ETH on MyEtherWallet or Trust wallet. Meanwhile, the users must take into account that the service costs 0.75% of the transaction.

How to make money staking ETH on Staking Pools

This staking option is for stakers who don’t have up to 32ETh or dedicated internet to run the Ethereum 2.0 software. The user can make choices among the various staking pools that allow staking in bits. The staking pool simply runs a node at the backend but enables users to stake virtually, joining forces with others to provide resources at agreed rates. Crypto traders can choose from available staking pools such as Staked, Ankr, Rocket Pool, Binance, Huobi, Everstake, Beefy Finance, and so on.

Staking pools include staking ETH to earn a specific token, BETH for Binance ETH 2.0, and HPT for Huobi. BETH, for instance, is an equity token collateralized 1:1 with ETH.

How to stake on ETH for BETH

Staking ETH on staking pools is very easy. Upon creating accounts on the staking pools, the users can follow the following procedures to make money staking ETH;

- Stake ETH; the users could earn BETH and HPT, and additional reward by using BETH, from staking ETH or providing liquidity ETH, BETH, or both to the ETH/BETH liquidity pool on Huobi/Binance.

- Wait for reward distribution; The staking pools regularly distribute on-chain rewards in the form of BETH to all participants based on their BETH position. If users sell before the snapshot time, they will not receive ETH 2.0 pledge chain rewards and HPT airdrop rewards for Huobi users.it is locked for 48 hours and can be traded once it is unlocked.

- Claim reward in ETH for BETH; Unlike running a full node, users must not wait till more than two years to unstake their ETH. The participants can swap BETH to ETH on a 1:1 basis and receive the amount equivalent of BETH.

How much to earn?

Before considering how much to make, there are few things to consider. They include; Current ethereum price, number of validators, staking method, and availability.

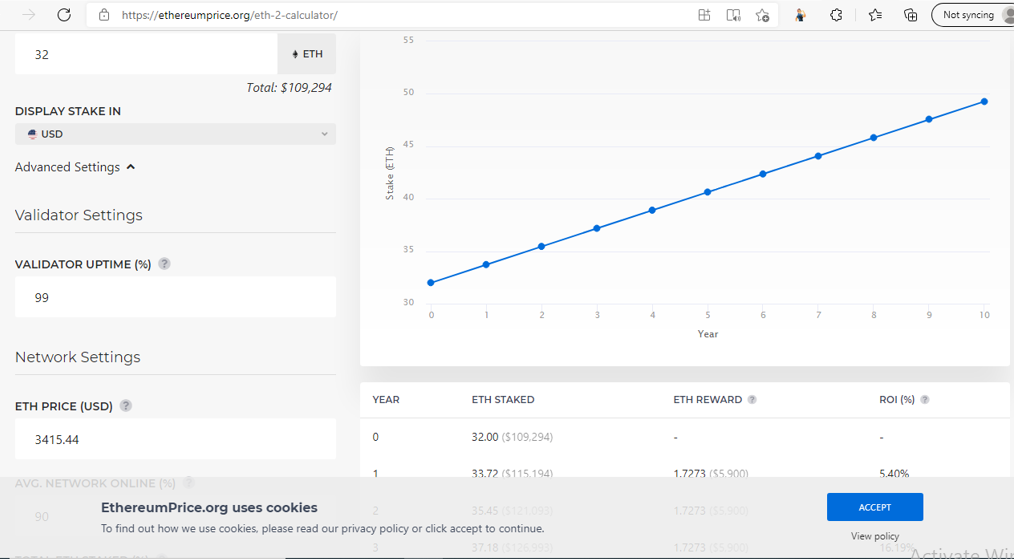

How much to make staking as a full validator or in a staking pool varies. To know the exact return to make staking ETH, you can proceed to Ethereum Calculator. Meanwhile, at the time of writing, staking 32ETH as shown below yields 5.40% in the first year, assuming there are 90 validators, 99 validator uptime, and that Ether is at $3415.44.

Assuming the number of validators increases, staking returns reduce. Also, if the price of Ether reduces, the reward drops in proportion to the drop.

As stated earlier, staking through staking pools have different rates. For instance, Binance, Beefy Finance, Huobi offer up to 20% APY, 20%APy and 6.85%APY depending on launchpads.